![]() On the 11th of March I bought shares in AbbVie (ABBV) at a price of USD 56.50 and a yield of 3.6%. At this price, Abbvie fulfilled five of seven of my investment criteria that I follow to build up financial independence. Find a detailed analysis here (PDF file).

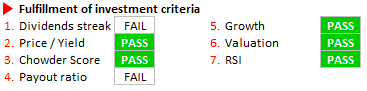

On the 11th of March I bought shares in AbbVie (ABBV) at a price of USD 56.50 and a yield of 3.6%. At this price, Abbvie fulfilled five of seven of my investment criteria that I follow to build up financial independence. Find a detailed analysis here (PDF file).

Exxon Mobil – 3.2% yield on a triple A-rated dividend champion

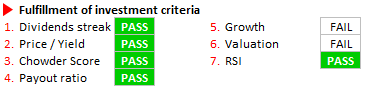

On the 16th of December I bought shares in Exxon Mobil (XOM) – along with purchases of Chevron (see below) – at a price of USD 87.50. At this price, Exxon Mobil fulfilled all but two of the seven investment criteria that I follow to build up financial independence. Find a detailed analysis here (PDF file).

Chevron – Adding a double A rated oil major at 4.2% yield to my income portfolio

On the 16th of December I bought shares in Chevron (CVX) at a price of USD 103.50. At this price, chevron fulfilled all but one of the seven investment criteria that I follow to build up financial independence in a strategic manner. Find a detailed analysis here (PDF file).

On the 16th of December I bought shares in Chevron (CVX) at a price of USD 103.50. At this price, chevron fulfilled all but one of the seven investment criteria that I follow to build up financial independence in a strategic manner. Find a detailed analysis here (PDF file).

Chevron is a multinational energy conglomerate that operates along the entire value chain of the oil and gas industry. Chevron is the fifth-largest energy company in the world with operations in more than 180 countries. It is a dividend champion with a track record of 27 consecutive years of dividend increases, thereby passing my first investment criteria.

Updated Watchlist and Investment Criteria

Good news today! I made a watchlist update and extended the investment criteria section of my blog. Both are closely linked to each other. Please feel encouraged to open up discussions for which I enabled comments on pages. Now you can leave your comments beneath my pages. Happy to discuss!

Good news today! I made a watchlist update and extended the investment criteria section of my blog. Both are closely linked to each other. Please feel encouraged to open up discussions for which I enabled comments on pages. Now you can leave your comments beneath my pages. Happy to discuss!