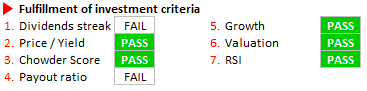

![]() On the 11th of March I bought shares in AbbVie (ABBV) at a price of USD 56.50 and a yield of 3.6%. At this price, Abbvie fulfilled five of seven of my investment criteria that I follow to build up financial independence. Find a detailed analysis here (PDF file).

On the 11th of March I bought shares in AbbVie (ABBV) at a price of USD 56.50 and a yield of 3.6%. At this price, Abbvie fulfilled five of seven of my investment criteria that I follow to build up financial independence. Find a detailed analysis here (PDF file).

Company overview

Company overview

AbbVie is a global, research-based biopharmaceutical company. AbbVie develops and markets advanced therapies that address some of the world’s most complex and serious diseases. AbbVie’s products are focused on treating conditions such as chronic autoimmune diseases, HIV and other health conditions such as low testosterone. AbbVie has a pipeline of medicines, incl. more than 30 compounds in Phase 2 or Phase 3 development across such medical specialties as immunology, virology/liver disease, oncology, renal disease, neurological diseases and women’s health.

AbbVie operates in one business segment—pharmaceutical products. Share of sales is 54% US and 46% international. Abbvie’s core product Humira generates approx. 63% of sales in 2014. Substantially all of AbbVie’s U.S. sales are to three wholesalers. Outside the US, products are sold primarily to health care providers or through distributors, depending on the market served. /Source: Company information

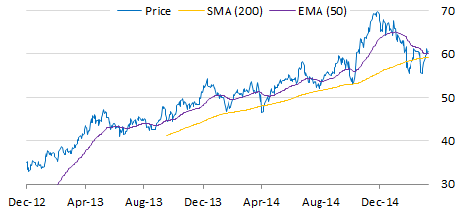

AbbVie Price Chart

AbbVie recently consolidated c. -20% from its 52-week high at 69.7 USD to approx. USD 56 which is slightly below its 200 day moving average. AbbVie underperformed the S&P 500 by 12.6% in the last 3 month, albeit performing in line with S&P 500 in the last 12 month. RSI indicates oversold territory at the current price of USD 56 passing my investment criteria 7. Dividend yield & payout ratio

Dividend yield & payout ratio

At 56.50 USD purchase price (11.03.2015) I realized an attractive dividend yield of 3.6%, which is above my target yield of 3.5%. AbbVie started paying dividends only recently after its spin-off from Abbott Labs, however, its parent company Abbott Labs paid dividends for 42 consecutive years, in a kind mitigating the FAIL in dividend streak investment criteria. AbbVie communicates strong commitment to growing its dividend. Additionally it approved a USD 5bn share repurchase program making it an interesting investment for dividend growth investors. Payout ratio in 2014 spiked to 158% due to one-offs in relation with the intended acquisition of Shire, unusually high FX and R&D impacts. However for 2015, management expects an EPS of 4.05-4.25 USD resulting in a payout ratio of c. 48%. Chowder score (using 5yr Div CAGR) is not applicable here, but using existing 2yr Div CAGR of 12.9% + 3.6% yield results in a Chowder Score of 16.5% well above the hurdle rate of 12%. All growth requirements are passed (S&P estimated long-term EPS growth is 15%, albeit the reported diluted earnings are significantly down to USD 1.10 in FY14).

Valuation (FY1 EV/EBITDA)

FY1 EBITDA is pretty stable at round 11.0x during the last 2 years. Recently, due to the above mentioned one-off effects, current EV/EBITDA and FY1 EV/EBITDA diverge. This divergence created an investment opportunity (based on investor’s insecurity in valuation) with AbbVie valued at 9.8x FY1 EBITDA (11.03.2015). This is well below its average valuation of 10.8x making it a buy from a valuation perspective.

Valuation (FY1 P/E)

Valuation (FY1 P/E)

Due to the trailing nature of P/E ratio calculation P/E diverges from FY1 P/E – as above – as FY14 results became immanent. Based on Mgmt guidance of 4.05-4.25 USD EPS in 2015, FY1 P/E declined with the declining stock price. The result was a FY1 P/E at c. 13.0x (11.03.2015), 2.0x below its average valuation level of 15.0x, signaling a PASS for my valuation investment criteria.

I added another position to AbbVie at $53.50. Thereafter the stock tanked to $48 making me sweat quite a bit but then nicely rebounced to $64. It is now trading in the high fiftees. I feel very comfortable owning AbbVie.

Best

germanDI