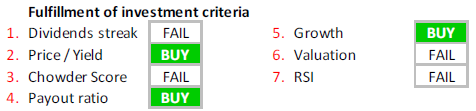

On the 15th of November I bought shares in BASF at a price of EUR 67.50. At this price, BASF fulfilled only three of my seven investment criteria. Find below the reasons I still considered an investment and a detailed analysis here (PDF file).

On the 15th of November I bought shares in BASF at a price of EUR 67.50. At this price, BASF fulfilled only three of my seven investment criteria. Find below the reasons I still considered an investment and a detailed analysis here (PDF file).

BASF is the largest chemical producer in the world headquartered in Ludwigshafen, Germany. The BASF Group comprises subsidiaries and joint ventures in more than 80 countries and operates six integrated productions sites and more than 390 other production sites in Europe , Asia, Australia, Americas and Africa. It serves well knowed customers in more than 200 countries and supplies products to a wide variety of industries. End of 2013, the company employed more than 112,000 people with more than 52,500 in Germany alone. In 2013, the company posted sales of c. EUR 74bn and adj. EBIT of EUR 7.2bn. The company currently seeks growth in emerging markets such as Asia. (Source: BASF, Wikipedia).

At a price of EUR 67.50 BASF fulfills only three of my seven investmen criteria. It misses on the dividend streak as outlined bellow but provides a yield greater than my 4% target.

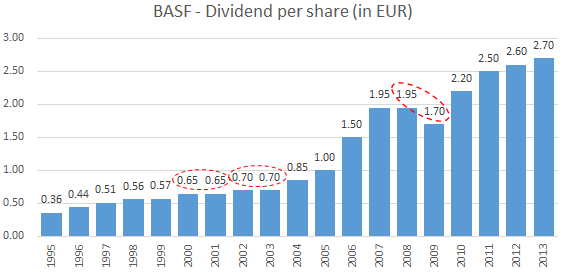

BASF is one of a few companies within the DAX30 that can present a dividend streak of 18 years. Starting from 1995 with EUR 0.36 per share, the company’s latest dividend (2013) was EUR 2.70 per share, representing a dividend growth of 11.8% p.a. BASF’s dividend policy is to increase or keep flat its dividend and provide investors with a yield >3%. The company was able to do so in the past 18 years, except in 2009, when the dividend decreased in light of the financial crisis from EUR 1.90 to 1.70. In the years 2011 and 2003 BASF managed to keep the dividend constant (vs. previous year) with all others years being dividend increases.

I consider BASF’s current dividend yield of 4% as attractive. It is well above its average yield at all periods (3Y, 5Y, 10Y). A yield of 4% can be realized at a stock price of EUR 67.5 (Div ’13: EUR 2.7) BASF’s dividend policy is to increase its dividend every year or to keep it constant, potentially lifting the yield well above 4%.

BASF currently trades around the EUR 68 mark which held as a price resistance in 2013 and acted as barrier in 2012 and 2011. A price of EUR 68 is only 4% above its 52-week low. The price seems appealing for me as I can buy the stock for prices seen beginning 2011 while operations improved. Choweder score is at 10.6% below my 12% cut-off point. Payout-ratio at 50% is ok. My growth criteria are fulfilled. Valuation and RSI are failed.

So why invest? BASF is world market leader in a specialised market with a very wide moat. It has a clear strategic growth path and a committment to shareholder value. On the European mainland its probably hard to find one of a kind as companies with only dividend inceases (so called dividend aristocrates) are hard to find. A 4% yield for a A+ rated DAX30 company in low interest environment is very attractive. As my watchlist contains monstly US stocks I consider BASF a geographic diversification.

For your convenience please find a printable version of Chevron’s stock analysis here (PDF file).