Following discussions on seekingalpha and making up my own mind, I classify dividend growth stocks in two categories: (1.) Core Dividend Stocks and (2.) Dividend Growth Stocks. The separation follows the idea of strategically building-up a portfolio representing stocks of both categories. Core dividend stocks provide higher yield, longer track record of increasing dividends, but slower dividend growth. Higher yields enables me to reinvest a higher amount of cash from dividends. Growth stocks instead provide an initally lower yield, shorter dividend track record but higher dividend growth rates. Over the long-term these stocks have potential to boost yield on cost. My ultimate investment goal will be my watchlist becoming my portfolio.

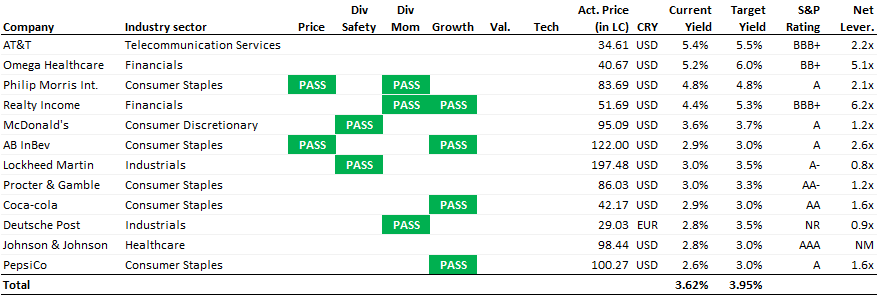

Price, Dividend Safety, Dividend Momentum, Growth, Valuation, and Technic represents my investment criteria. The green “PASS” field indicates that the respective investment criteria is currently fulfilled for the specific company.

1. Watchlist – Core Dividend Stocks

Dividend stocks usually have a higher yield, a longer streak of increasing dividends, but less growth prospects.

2. Watchlist – Dividend Growth Stocks

Dividend growth stocks have usually lower yield, a shorter streak of increasing dividends, but a stronger growth profile.

Understanding the table

Beyond the name, the Industry Sector is the one developed by the rating agency Standard & Poors and the global financial information provider MSCI. It provides 10 sectors. An overview of the sectors can be found on wikipedia here. With a closer look you recognize that my watchlist contains companies from each of the ten sectors (except utilities). The companies are well diversified across the industry sectors.

Price column

The price column relates to my 2. investment criteria. A green “PASS” indicates that the current dividend yield is above its 5 year average and/or above my target yield. To find out how I derive the target yield, please visit investment criteria.

Dividend Safety + Dividend Momentum column

The dividend safety column relates to my investment criteria 3. and 4. I require a Chowder Score of 12% and a payout ratio of below 55%. If these two criterias are fulfilled its signalled via the green “PASS”. I added dividend momentum in this table which is a “PASS” if a company’s 3-year dividend CAGR is greater than its 10-year dividend CAGR. Therefore, it signals stronger dividend growth most recently, being an indicator for a healthy business model rewarding shareholder with even greater dividends in recent years.

Growth

The Growth column relates to my investment criteria 5. To qualify for a long-term investment I require companies to have grown their revenues and their earnings per share (EPS) in the past five years greater than 5%. Why 5%? As a dividend investor the trade-off is most of the time between dividend growth and current yield. Keeping your purchasing power in an inflationary world (expected “real” inflation to be 3-4%), I require at least some growth on the top of inflation. Further I require a positive future consensus outlook, i.e. next five year EPS >5%.

Valuation

The Valuation column ensures that I do not overpay for a company, reflected in investment criteria 6. It requires EV/EBITDA and P/E multiple at or below their last five year averages. That reduces my risk buying overpriced stocks. Read more in my investment criterias.

Technical

The Technical column enables me to buy on (short-term) stock price dips using the Relative Strenght Index (RSI) as indicator (investment criteria 7.)

Thanks for putting together a nice website. I like your stock selection, many of your watchlist candidates are members of my portfolio. A couple of questions/comments.

1) Seadrill stopped paying a dividend but you still have it in your DG portfolio, what is your thinking here?

2) Why do you have the REITs realty inc and omega healthcare listed as financials?

3) Gilead recently introduced a dividend (around 1.7% as far as I remember), maybe worth an update of your table.

mfg

EDGI

Dear EDGI,

thanks for commenting and the interesting questions which I happily answer below! The site is not yet ready as you probably recognize but I try my best to at least update “the basics” in regular manner. The rest will follow as soon as I find time. Happy that you like it so far!

With regards to your questions:

1) Well, Seadrill is by far the largest (unrealized) loss position in my portfolio (-70%). I held on to Seadrill as Mgmt clarified the dividend to be safe for at least until end of 2016. AS we know now it was not. I considered to realize the loss end of 2014. However, selling at the low (?) of the oil price and at a kind of “panic” mood in the oil drillers market seems not the best solution to offload Seadrill. Further, I did not need (tax) losses to reduce my years capital income. This might be different in 2015. Conclusion, I will sell Seadrill latest end of 2015 hoping to find a higher exit price than the current.

2) Actually I thought about reclassifying into “REITs” because REITs provide a business model differentiating from most of the other dividend paying companies. However, so do e.g. banks and insurances etc. The Global Industry Classification Standard classifieds REITs as a sub group of “financials”. Thats why I stick to “financials” as industry classification. From a visibility point of view I am with you, to name these REITs.

3) I am using S&P Capital IQ as source of my data. S&P calculates the yearly dividend by annualizing the latest dividend and multiplying 4x. As there is no dividend paid yet the dividend is 0%. You are right when looking at the FY1 (estimated) dividend yield.

All the best

germanDI

thanks for the response, makes sense!

cheers

EDGI