On the 16th of December I bought shares in Chevron (CVX) at a price of USD 103.50. At this price, chevron fulfilled all but one of the seven investment criteria that I follow to build up financial independence in a strategic manner. Find a detailed analysis here (PDF file).

On the 16th of December I bought shares in Chevron (CVX) at a price of USD 103.50. At this price, chevron fulfilled all but one of the seven investment criteria that I follow to build up financial independence in a strategic manner. Find a detailed analysis here (PDF file).

Chevron is a multinational energy conglomerate that operates along the entire value chain of the oil and gas industry. Chevron is the fifth-largest energy company in the world with operations in more than 180 countries. It is a dividend champion with a track record of 27 consecutive years of dividend increases, thereby passing my first investment criteria.

CVX currently trades at slightly above the 100 USD mark at its 52-week low which held as a price resistance in 2011/12 . Market fundamentals, in particular the supply / demand balance of oil is currently unclear, causing a lot of investors to drop the shares of oil majors.. I expect some further declines, however I start to build up positions from here above 4% dividend yield.

The current dividend yield of 4.2% is very attractive, well above its 5 year average yield. A yield of 4.2% can be realized at a stock price of USD 102. CVX has no official dividend policy however is committed to ‘larger’ dividends / yield. Payout ratio of 54% is ok. Chowder score is 13.7% resulting from 9.5% last 5 year dividend CAGR and 4.2% dividend yield. This is well above my hurdle rate of 12 %. All my growth requirements are fulfilled with last 5 year revenue CAGR >5%, last 4 year EPS CAGR >5%, and next 5 year EPS CAGR (estimate) >5%.

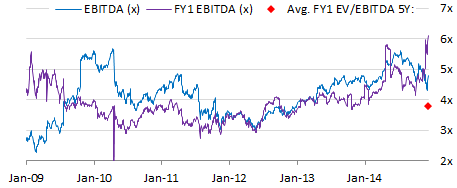

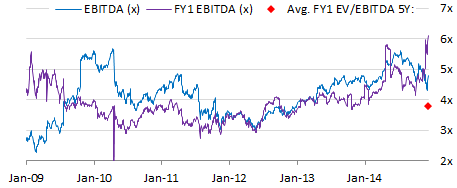

EBITDA FY1 valuation has come down recently to 5.1x . I consider 4.0x a long-term sustainable level, so, on the current level, CVX seems still to be overvalued by 1.0x FY1 EBIDTA. However, the current EBITDA ratio is lower (4.5x) coming closer to the fair level of 4.0x, partly mitigating failure in investment criteria 6. Valuation.

CVX currently trades on its long-term current P/E ratio of 9.4x. However, its FY1 P/E is substantially above its 5yr average. I assume that recently lower analysts expectations along with the drop in oil price caused FY1 to spike.

Overall I am more than happy to have added this AA rated (S&P) behemoth at a 4.2% yield to my growing income portfolio. As I write this article, CVX shares increased by 9% vs. my entry price to c. USD 113.

For your convenience please find a printable version of Chevron’s stock analysis here.