![]() On the 11th of March I bought shares in AbbVie (ABBV) at a price of USD 56.50 and a yield of 3.6%. At this price, Abbvie fulfilled five of seven of my investment criteria that I follow to build up financial independence. Find a detailed analysis here (PDF file).

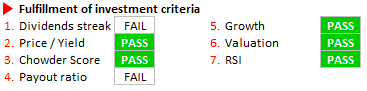

On the 11th of March I bought shares in AbbVie (ABBV) at a price of USD 56.50 and a yield of 3.6%. At this price, Abbvie fulfilled five of seven of my investment criteria that I follow to build up financial independence. Find a detailed analysis here (PDF file).

Category Archives: Stocks

Exxon Mobil – 3.2% yield on a triple A-rated dividend champion

On the 16th of December I bought shares in Exxon Mobil (XOM) – along with purchases of Chevron (see below) – at a price of USD 87.50. At this price, Exxon Mobil fulfilled all but two of the seven investment criteria that I follow to build up financial independence. Find a detailed analysis here (PDF file).

Chevron – Adding a double A rated oil major at 4.2% yield to my income portfolio

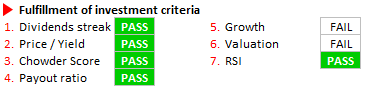

On the 16th of December I bought shares in Chevron (CVX) at a price of USD 103.50. At this price, chevron fulfilled all but one of the seven investment criteria that I follow to build up financial independence in a strategic manner. Find a detailed analysis here (PDF file).

On the 16th of December I bought shares in Chevron (CVX) at a price of USD 103.50. At this price, chevron fulfilled all but one of the seven investment criteria that I follow to build up financial independence in a strategic manner. Find a detailed analysis here (PDF file).

Chevron is a multinational energy conglomerate that operates along the entire value chain of the oil and gas industry. Chevron is the fifth-largest energy company in the world with operations in more than 180 countries. It is a dividend champion with a track record of 27 consecutive years of dividend increases, thereby passing my first investment criteria.

BASF – Why this 4% yielding stock is worth an investment

On the 15th of November I bought shares in BASF at a price of EUR 67.50. At this price, BASF fulfilled only three of my seven investment criteria. Find below the reasons I still considered an investment and a detailed analysis here (PDF file).

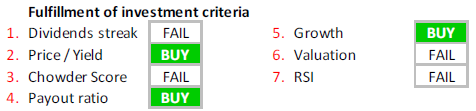

On the 15th of November I bought shares in BASF at a price of EUR 67.50. At this price, BASF fulfilled only three of my seven investment criteria. Find below the reasons I still considered an investment and a detailed analysis here (PDF file).

BASF is the largest chemical producer in the world headquartered in Ludwigshafen, Germany. The BASF Group comprises subsidiaries and joint ventures in more than 80 countries and operates six integrated productions sites and more than 390 other production sites in Europe , Asia, Australia, Americas and Africa. It serves well knowed customers in more than 200 countries and supplies products to a wide variety of industries. End of 2013, the company employed more than 112,000 people with more than 52,500 in Germany alone. In 2013, the company posted sales of c. EUR 74bn and adj. EBIT of EUR 7.2bn. The company currently seeks growth in emerging markets such as Asia. (Source: BASF, Wikipedia).

At a price of EUR 67.50 BASF fulfills only three of my seven investmen criteria. It misses on the dividend streak as outlined bellow but provides a yield greater than my 4% target. Continue reading

Continue reading